While the fastest-growing sector is currently biotech, Finnish angel investors find health tech the most attractive investment prospect. Tesi’s investment director Joni Karsikas is pleased with Tesi’s and FiBAN’s latest research results, which indicate that in future years these sectors will offer attractive prospects for later-stage investment.

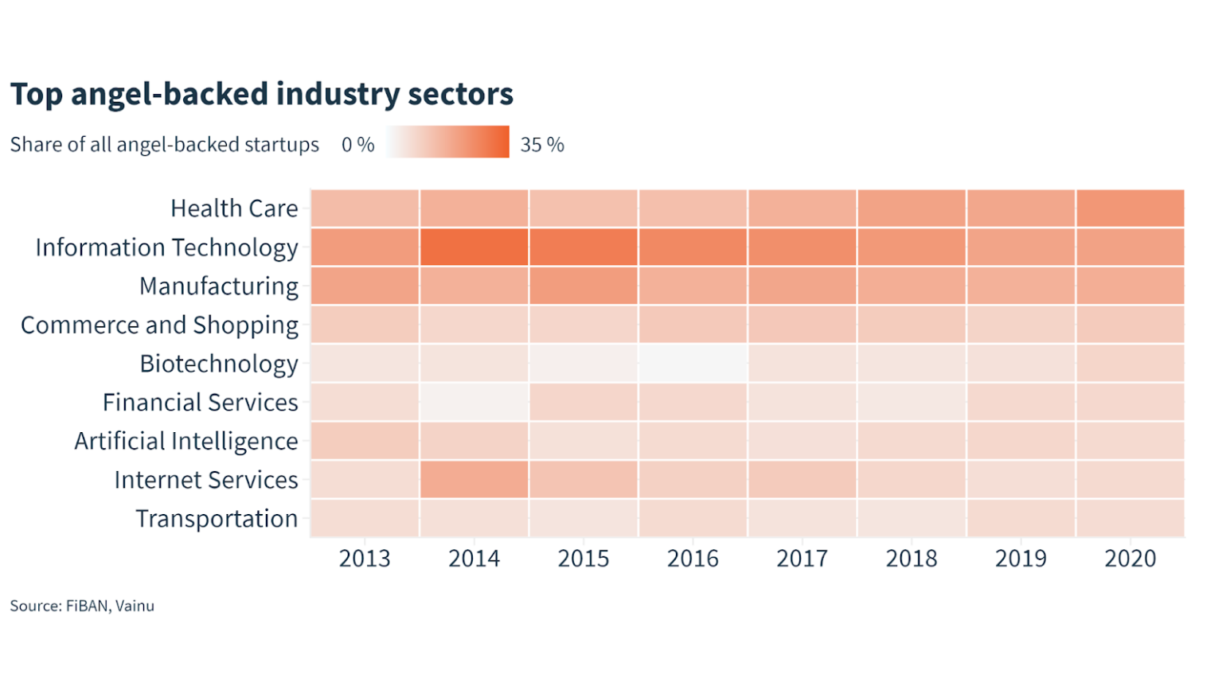

Charting trends in angel investing, the study used a new algorithm developed by Finnish software company Vainu, that automatically classifies startups based on their websites. The research material covers 1,178 startups that received angel financing between 2013 and 2020.

“The results indicate which sectors in Finland have offered early-stage investors a good quality deal flow. They also help in forecasting from which sectors companies needing later-stage financing will emerge. It’s great to see that the health tech sector is doing so well,” Joni Karsikas says.

Last year health tech became the most popular target for angel investments, outstripping the IT sector for the first time – even though IT’s popularity remained strong and stable throughout the review period.

Healthtech resonates with angel investors’ values

Karsikas believes the most probable cause for angel investors’ heightened interest is the better quality of health tech projects. There are simply more well-founded projects to choose from.

“Angel investors favour sectors known to them from experience. It’s generally accepted that health tech projects resonate with angel investors’ values: many are keen to contribute to improving people’s wellbeing,” Karsikas remarks.

One explanation involves the dynamics of investing. Venture capital funds and institutional investors prefer to select projects for their portfolios that will rather quickly start generating revenue. Typically, these include IT projects. Angel investors, on the other hand, might be more willing to invest with a longer horizon.

“Healthtech is a highly regulated and conservative sector, so bringing a new product to market is a lengthy process. There are some promising health tech companies in Finland that have financed their startup phases completely with angel investments, and then later transitioned to VC investors and other financing channels in their own sectors,” Karsikas points out.

Earlier years’ failures forgotten

Biotech’s rapid rise as a magnet for angel investing is striking. During 2015–2016 the sector raised only a few early-stage investments, but by 2020 biotech had become the fifth most popular investment target amongst angel investors. Biotechnology is an area of biology and biochemistry, and biotech applications are widely used in innovative product development, such as the manufacture of pharmaceuticals and nutriments.

“Variations in investment activity could perhaps be a consequence of the failed investments in pharmaceutical development of earlier years. Those wounds have now healed, and investors are returning to the sector having learned their lesson,” Karsikas concludes.

Tesi (Finnish Industry Investment Ltd) is a state-owned investment company that wants to raise Finland to the front ranks of transformative economic growth by investing in funds and directly in companies. We invest profitably and responsibly, hand-in-hand with co-investors, to create the world’s new success stories. Our investments under management total 2.1 billion euros. www.tesi.fi | @TesiFII